Ottawa’s MLS® Market Activity Shows Strong Start to the Year

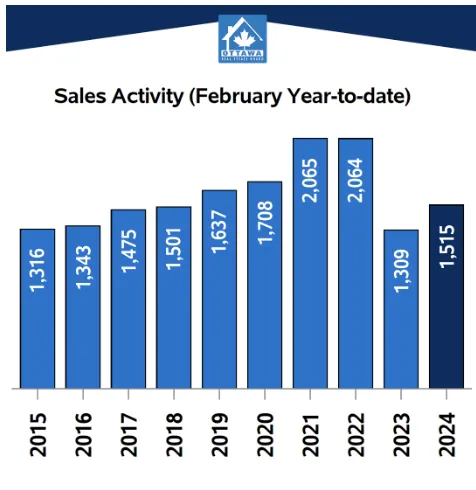

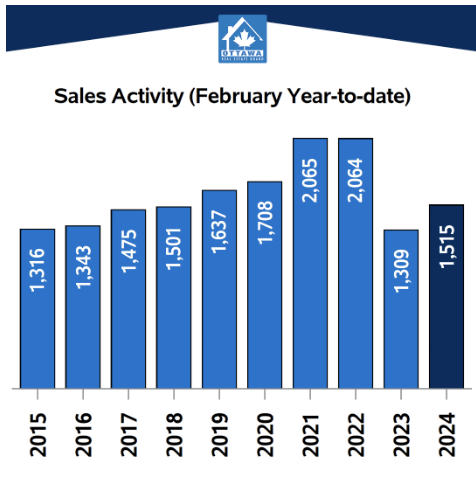

The number of homes sold through the MLS® System of the Ottawa Real Estate Board totaled 886 units in February 2024. This was an increase of 15.2% from February 2023.

Home sales were 13.8% below the five-year average and 5.7% below the 10-year average for the month of February.

Even with higher prices and the interest rate holding steady, Ottawa is a strong, active market,” says OREB President Curtis Fillier. “With metrics across the board up from last year, it’s clear both buyers and sellers are making moves. The metrics, however, don’t tell us about all the people relegated to the sidelines because affordability remains out of reach for many.”

The Municipal Property Assessment Corporation (MPAC) recently reported that “communities with homes under $500,000 are becoming increasingly scarce.” A decade ago, 74% of Ontario residential properties had a home value estimate of less than $500,000 but that number has dropped to just 19% today.

“REALTORS® know firsthand there is persistent demand for housing in Ottawa, and our market’s activity is constrained by a lack of affordable and suitable supply,” says Fillier. “That’s why we’re currently advocating for impactful measures such as allowing four residential units on property lots and getting rid of exclusionary zoning. There’s a missing middle that we need to build up.”

By the Numbers – Prices:

The MLS® Home Price Index (HPI) tracks price trends far more accurately than is possible using average or median price measures.

The overall MLS® HPI composite benchmark price was $628,500 in February 2024, a gain of 2.8% from February 2023.

The benchmark price for single-family homes was $708,500, up 3.1% on a year-over-year basis in February.

By comparison, the benchmark price for a townhouse/row unit was $495,000, up slightly at 0.6% compared to a year earlier.

The benchmark apartment price was $417,000, up 2.7% from year-ago levels.

The average price of homes sold in February 2024 was $651,340, increasing 2% from February 2023.

The dollar volume of all home sales in February 2024 was $577 million, up 17.5% from the same month in 2023

OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

By the Numbers – Inventory & New Listings:

The number of new listings saw an increase of 29.5% from February 2023. There were 1,539 new residential listings in February 2024. New listings were 10.3% above the five-year average and 3.3% below the 10-year average for the month of February.

Active residential listings numbered 2,158 units on the market at the end of February 2024, a gain of 16.3% from February 2023. Active listings were 59.6% above the five-year average and 17.7% below the 10-year average for the month of February.

Months of inventory numbered 2.4 at the end of February 2024, unchanged from February 2023. The number of months of inventory is the number of months it would take to sell current inventories at the current rate of sales activity.

Ready to Start?

Select Real Estate

Corinne Campbell & Kim Ziebell

REALTOR®, Brokers

(613) 701-9490

2141 Thurston Drive, Unit 103